Exchanges tend to range from being quite user-friendly to difficult to comprehend for the average Joe. Binance falls somewhere in-between – however, there are plenty of reasons to use this exchange when trading cryptocurrencies.

PROS

✓ The highest liquidity on the market

✓ Allows buying crypto via debit/credit cards or via bank transfers

✓ Users can withdraw their funds via debit/credit cards or via bank transfers

✓ Hundreds of crypto pairs

✓ A state-of-the-art mobile app

✓ Extremely low fees

✓ A referral and affiliate program that rewards you for bringing users to the exchange

✓ High security

✓ Margin trading and futures trading

CONS

✗ Steep learning curve

✗ Could be difficult to understand for beginners

✗ Non-responsive customer support

How it started

At the very beginning, the founders of Binance raised capital for their venture through an initial coin offering (ICO) – a crowdfunding event which rewards inventors with newly created tokens. The ICO participants sent roughly $15 million worth of Ethereum, and in return, they received the Binance Coin (BNB). Nowadays you get a 50% discount in case you trade with BNB on Binance.

The exchange has managed to become the largest one since its inception back in 2017 – mainly due to its lavish referral program. Users can invite their friends and earn up to 40% of the commissions from their trades – which used to be unheard of. To this day, few exchanges offer such generous terms. At the time of writing the daily trades on the exchange reach the astounding 180 billion USD per day.

Binance’s Advantages

✓ Low Fees

Each centralized crypto-exchange charges fees when buying or selling cryptocurrencies on it – however, Binance’s fees are some of the lowest in the industry, especially when compared to one of its main competitors, Coinbase. Binance users pay 0.1% per trade, while the ones on Coinbase are charged 2%!

When you deposit crypto to the exchange, it doesn’t cost anything, however any withdrawals whatsoever are charged. Be aware that each fee varies according to the cryptocurrency. And since the fees are a percentage of the crypto you’re withdrawing and are not corresponding to any fiat currency, you may sometimes pay substantial fees when you look into their Dollar equivalent. For instance, if you want to withdraw QTUM, it would cost you 0.01 QTUM – which in some cases may cost you 0.12$ and in others – 0.50$.

You can deposit as much crypto as you want to, however, there is a limit on the crypto you can withdraw – you are required to pass further verification if you’d like to withdraw more than 2 BTC worth of crypto. As part of their AML policies you’d need to present your ID such as a passport.

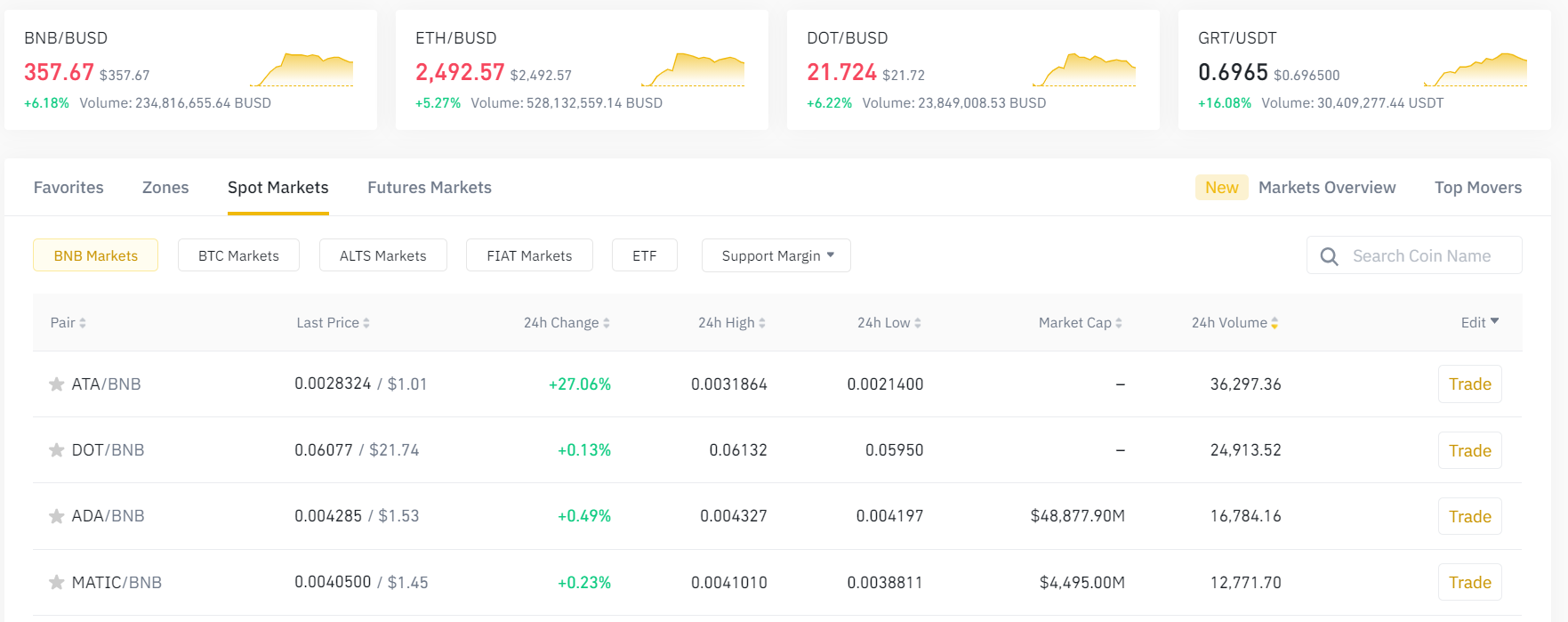

✓ Great variety of trading pairs

Binance’s popularity can also be attributed to the wide range of cryptocurrencies that are listed on the exchange. There are hundreds of coins and tokens to choose from.

✓ Giveaways

Binance occasionally rewards regular users with giveaways so keep an eye on the newsletters by them.

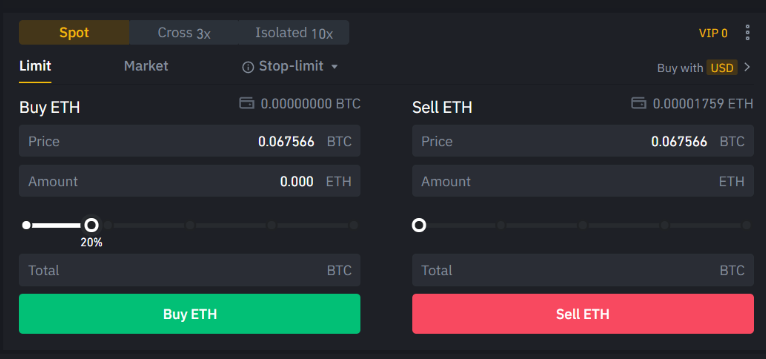

✓ Margin trading

Binance allows traders to use leverage by borrowing funds from the exchange. You can try cross-margin trading (x3) or isolated trading (x5) to increase the amount of crypto you are trading with. Keep in mind that the higher reward opportunity also means higher risk as a serious movement in the opposite direction may wipe out your entire margin portfolio!

✓ Secure

In terms of safety, Binance utilizes the trustworthy CryptoCurrency Security Standard (CCSS) so that the accounts are protected – an industry-standard for the major exchanges.

Binance users are also prompted to set up a 2FA on their phones, which is an additional level of security, providing you with a unique code each time you’d like to log into the exchange, trade crypto, or make a withdrawal.

✓ Fiat currencies

Binance accepts a multitude of fiat currencies (all of the major ones, such as USD, EUR, AUD, etc.). The P2P (person-to-person) trading even supports over 150 payment methods and 49 fiat currencies!

✓ High Liquidity

The volume of trades taking place each day on Binance is truly mind-blowing. This means that unlike some of the smaller exchanges, the risk of not having enough buyers or sellers of a certain cryptocurrency is lower. You are able to trade on the spot and in greater volumes, without affecting the price negatively.

Binance’s Disadvantages

✗ Ease of use

Binance can definitely feel overwhelming to some of the new users. There are a lot of options and some of the trading methods may seem quite complicated at first (e.g. margin trading, futures, etc.).

The good news is that there is plenty of material that will prepare each of them. Just go over to the Binance Academy and dive into the articles that explain everything – from the essence of blockchain to the ways you can use Binance.

✗ Customer Support

Due to the large customer base that Binance has to serve, contacting the support team via email usually means waiting for days or even weeks till there is a reply. There is the option for a live chat as well, although waiting queues can also be bothersome. Binance does not offer any phone support, unlike other exchanges such as Coinbase.

Trading on Binance

Let’s say you want to trade Ethereum with the BTC that you currently possess.

1. Go to the header and select ‘Markets’

2. Type in the code of the crypto you’d like to trade buy or sell – in this case ETH (which stands for Ethereum). Clicking on a pair (such as ETH/BTC), will redirect you to the platform’s trading section.

3. Don’t worry if you are startled by the abundance of information at first!

You will see the three main ways of buying crypto – Limit, Market and Stop-Limit. Basically, what this means is that when you click on ‘Market’ the order is automatically fulfilled by the exchange, buying immediately at the highest price being offered at the moment. If you click on ‘Limit’ you can specify the exact price at which you’d like to buy the asset – you need to pay attention to the prices being displayed on the left in order to get a better understanding of the latest pricing. If you find this to be too overwhelming, then we recommend starting off with a ‘Market’ order. Keep in mind that the fee for a Market order is 0.5%, while the one for Limit is 0.1%.

4. As you proceed, you’d need to put in the amount of crypto you would like to purchase. There are two main courses of action. Either you specify the quantity of coins you’d like to buy in the ‘Amount’ field or you can choose a percentage of your BTC (or USDT or whatever asset you are trading against) you’d like to exchange.

5. Clicking on the big green button (in this case – Buy ETH) will open your order. If you have selected Market, then your order should complete in a matter of seconds!

6. In case you want to verify that the trade has been successful , scroll down to the bottom of the page and click on ‘Funds’.

7. And that’s it!

Overview

Binance is a perfect choice both for experienced traders and newcomers. Nowhere else will you have such an abundance of options for trading – from classic, through cross and isolated margin to futures. Thanks to the Binance Academy everything becomes crystal clear even to people who were unfamiliar with Bitcoin up until recently!

Score

5/5

Nothing on this website should be perceived as financial, investment or trading advice. We urge you to do your own research prior to investing and we highly recommend that you consult a certified financial advisor.

Tell us what topic you’d like

Us to cover!

Our objective is to make the world of crypto more comprehensive to everyone out there