We have some good news for you. It is possible to make money from crypto even in times of a bear market when the prices of crypto tend to go downwards. One of the best ways to do this is through the action, known as ‘staking’. What is staking? It is the process of taking part in transaction validation.

While mining utilizes actual machinery to reach consensus (the so-called ‘proof-of-work’), the proof-of-stake (PoS) blockchains only require you to have a minimum balance of a specific cryptocurrency so you can validate transactions and thus earn staking rewards. Usually you can do that via a cold storage but some exchanges facilitate the process greatly, allowing you to stake via their platforms.

Staking on Binance

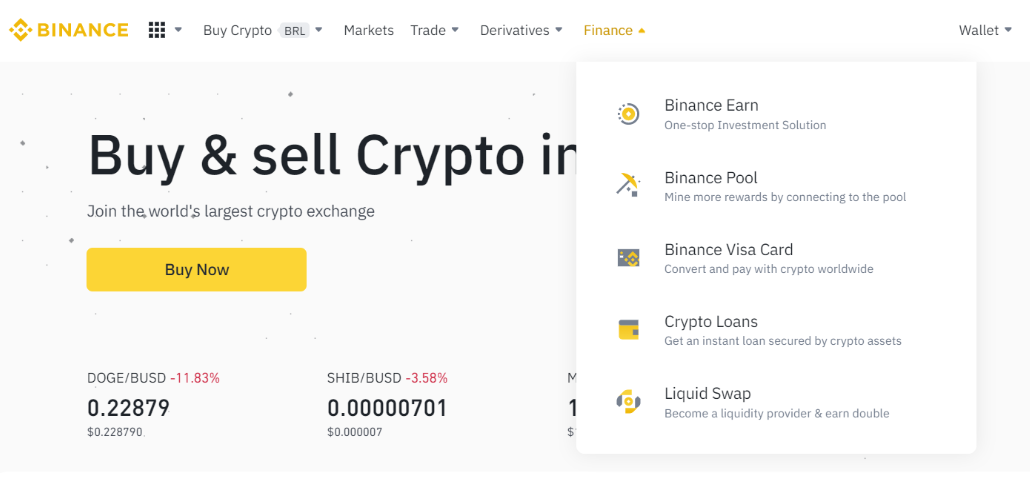

If you are on Binance, you have plenty of staking opportunities. Once you log in, click on ‘Finance’ and then on ‘Binance Earn’.

The APY or Annual Percentage Yield that you are presented with is a bit like the interest you’d be getting on having your money in the bank. During the locked period your coins cannot be traded and there could be penalties for withdrawing your funds earlier. You’d get your initial stake back, but not whatever you have earned for this period.

IMPORTANT: The percentages that you see on Binance are not what you’d get for the said period (e.g. 30-day of staking) but what the APY is, in other words how much you’d get if you stake it for an entire year. So if it says 12% of APY on the 30-day period, this actually means that you’d get 1% at the end of the month.

Keep in mind that you are paid out in the coin that you stake. It is based on the amount of coins you are staking (or delegating) in your wallet. Therefore the USD-value of the coin you are paid in will swing – it may be 1 Dollar a day or 50 Dollars a day, depending on the price of the coin in fiat. Look beyond the yearly yield – some offer huge APYs, but there are things to take into consideration when selecting which coin to stake:

- Minimum requirements – the minimum staking period may be quite high, which is associated with a lot of risk, especially if it’s a newer, less established coin. Even a couple of months can be considered a long time when it comes to crypto

- The emission of coins – high emission rate is to be noted – in the short-term it may not be an issue but in the long-term if you are thinking of holding that coin this can lead to inflation, similar to the way national fiat currencies are being inflated.

- The 24-hour trading volume of the coin being staked – if it has a low trading volume and you have huge chunks of it, you will be pushing the price down when selling it

- APY fluctuation – just because you are being shown a certain APY, doesn’t mean that you will continue to receive it throughout the entire year. Ethereum 2.0 for example is designed in such a way that the more people stake on the network, the less you earn. It’s the same with Cardano – if a validator is too saturated with staked ADA coins, the rewards then are degraded. This is their incentive model to create more decentralization rather than have several huge players. Therefore, if you are staking Cardano outside of an exchange, it is better to have several validators to make sure you earn from all of them, rather than put all of your eggs in one basket.

The more money is locked up in a cryptocurrency, the more secure it is – similar to proof-of-work where the more computing power is utilized, the better the system’s security is.

There are around 30 coins that can be staked on Binance. There are different durations in terms of days that you can pick from – from 30 days upwards. Some of these time-locking periods may be sold out though due to the huge interest towards the coins. Check out which ones are currently available and decide for yourself whether or not you’d like to earn a passive income via Binance (and, naturally, read their terms & conditions carefully before that).

Nothing on this website should be perceived as financial, investment or trading advice. We urge you to do your own research prior to investing and we highly recommend that you consult a certified financial advisor.

Tell us what topic you’d like

Us to cover!

Our objective is to make the world of crypto more comprehensive to everyone out there

0 Comments